Acquisition by defence giant Lockheed Martin in January has put Procerus Technologies, a manufacturer of avionics for small unmanned aircraft systems, on the product-development fast track.

Acquisition by defence giant Lockheed Martin in January has put Procerus Technologies, a manufacturer of avionics for small unmanned aircraft systems, on the product-development fast track.

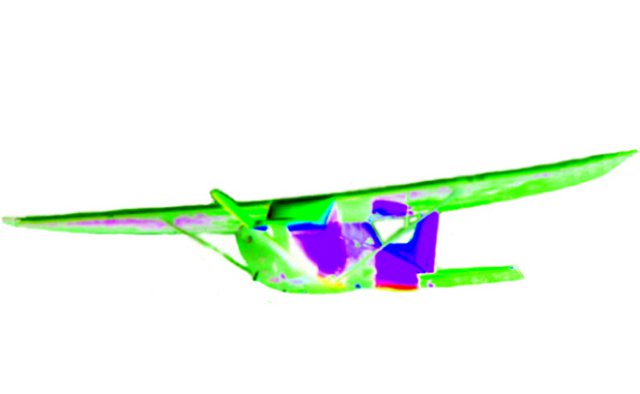

Just six months later, Procerus showcased the results of an infusion of resources from its new parent, flying a new vertical-take-off-and-landing (VTOL) micro-UAS complete with hand controller, digital data link and dual-sensor gimbal—all developed since the takeover.

“Lockheed has given us the IRAD [independent R&D] resources to accelerate product development,” says Todd Titensor, Procerus’s founder. “Development of the VTOL, gimbal, hand controller and data link all began in March—and we had not planned the VTOL,” he says. “They have added to our ability to be successful.”

Titensor, a former director of worldwide marketing for Word Perfect and a radio-control aircraft enthusiast, formed Vineyard, Utah-based Procerus in January 2004. The company’s main product is the Kestrel autopilot, used in a number of different small UAS. Its main competitor is the Piccolo autopilot, also developed by a small company that was purchased by Goodrich and is now owned by United Technologies. Lockheed Martin has been a customer for Procerus since before the acquisition, he says.

Procerus developed the Virtual Cockpit Windows-based ground control station to work with its Kestrel autopilot and has since branched out into vision-based navigation with its OnPoint Targeting software, which allows the operator to command the UAS to fly to a location or follow a moving target autonomously using its gimbaled sensor payload.

Vision-based guidance will enable the company’s VTOL UAS to navigate without GPS, outdoors and indoors. To perch and stare, for example, the operator will click on the roof of a building in the sensor video and the vehicle will fly itself to the location and land autonomously. Procerus also is working on making small unmanned aircraft lethal, says Titensor, for example by using vision-based flight control to guide the UAS through the windshield of a speeding vehicle.

Historically, the company’s business model is to be the “Intel inside” and not compete with its customers, but the VTOL small UAS market has not materialized for its autopilot because the credible suppliers are all vertically integrated, says Titensor. The decision was taken to develop a product “so Lockheed Martin could go after the VTOL market, military and commercial, and provide all of the system.” Compared with many of the VTOL UAS available, Procerus’s system is “aerospace-grade,” he says.

Simultaneously, the 24-employee company developed the 200-gram electro-optical/infared sensor gimbal and a digital data-link, in the hand controller, enabling both command-and-control and video signals to be carried over the same Internet Protocol-based radio link. The gimbal exploits “a breakthrough in motors,” eliminating stepper gearboxes to make the sensor more rugged, and offers point accuracy that will “blow away” the competition, he says.

Formerly privately held, Procerus continues to operate as a commercial entity with Lockheed Martin Mission Systems & Sensors. “They want us to operate the way we did, and not to change our tactics or marketing. They want Kestrel to be used everywhere,” says Titensor. “We will be rather independent. Lockheed Martin’s Desert Hawk [small UAS] team operates that way, and they want us to be agile and fast.”

Deliveries of the still-unnamed VTOL micro-UAS are expected to begin toward the end of the year. The initial market will be military, with commercial demand depending on how soon the FAA opens up national airspace to civil UAS. The U.S. Army is opening up its small UAS program to competition, and Titensor sees commercial demand from first responders. “They have a demonstrated need, and the first requirements.”

Source: Aviation Week