A major milestone has been recorded by the Australian unmanned aircraft industry with the Australian Civil Aviation Safety Authority (CASA) having now certified more than 100 commercial UAV operators. The milestone was reached during the course of last week.

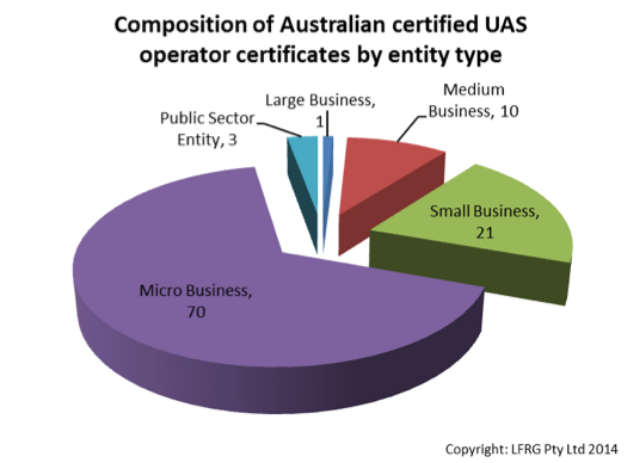

Analysis of CASA’s certificate holder records commissioned by the Australian Certified UAV Operators Association (ACUO) confirms micro and small businesses are the driving force behind the industry in Australia, rather than traditional aerospace and defence sector companies.

The dominance of small start-ups in the domestic market raises significant industry policy challenges for Australian government policy makers according to Joe Urli, ACUO President.

“The structure of the unmanned aircraft industry as a whole in Australia is dominated by small and micro enterprises, with these holding 91 of all issued certificates. Micro enterprises, comprising less than five people, hold 70 certificates.

Just one registered Australian large business holds a certificate, with this a non-traditional aerospace company. Only three public sector entities currently hold certificates.

“The message to public policy makers that flows from these facts is very clear: the unmanned aircraft industry as it is developing in Australia is purely commercially driven in its focus and should not be treated as simply an extension of the traditional aerospace and defence industrial bases.”

The analysis reveals that with the exception of two Australian-based subsidiaries of US firms, AAI Aerosonde and Insitu, it is clear that medium and large Australian and multinational aerospace and defence sector firms do not appear to be proactively seeking CASA unmanned aircraft operator certification at the current time.

“This may reflect the parameters of CASA’s regulations as currently stand, which do not allow beyond line of sight operations of larger unmanned aircraft.

“While those regulations are planned to evolve over the next two years, the immediate supplier base is clearly defined by a bottom up approach, rather than top down. This is unlikely to change even when the regulations do broaden, because the market dimensions are unlikely to provide many opportunities for larger systems. Where those opportunities do merge, in the medium to long term, government requirements will predominate. The overall dominance of micro and small companies will continue unabated.

“This market reality directly contrasts with most Australian government policy for the aerospace and defence sectors, which is dominated from the top with micro and small enterprises rarely assessed as having potential to act in market shaping and market defining ways”, says Urli.

The rate of unmanned aircraft operator certificate approvals by CASA has greatly accelerated the past 18 months, with the total number of holders doubling twice during this period.

“The most rapid period of growth in certificate issuance has been during the past four months” says Urli. “We see this sudden surge as indicative of a pent-up demand that will only increase, particularly given the broad market space available to start-ups.”

CASA issued its first unmanned aircraft operator certificate on 28 November 2002 to the Brisbane-based company HELImetrex. Over the next 11 years that number would climb, by January 2013, to just 27 certificates.

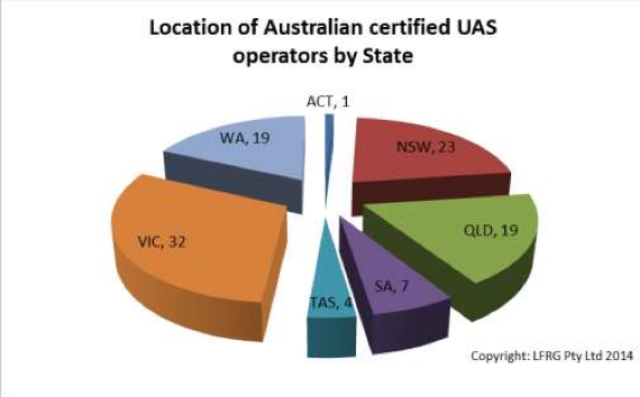

Victoria has emerged as the clear powerhouse of the emerging national industry with a total of 32 certificate holders, followed by New South Wales with 23. Western Australia and Queensland sit in equal third place with both having 19 certificate holders.

South Australia, which has an active state government policy of seeking to develop the unmanned systems industry as part of its forward business strategy, has just seven certificate holders. Tasmania has four certificate holders while the Australian Capital Territory has one. There are no current operator certificate holders registered in the Northern Territory.

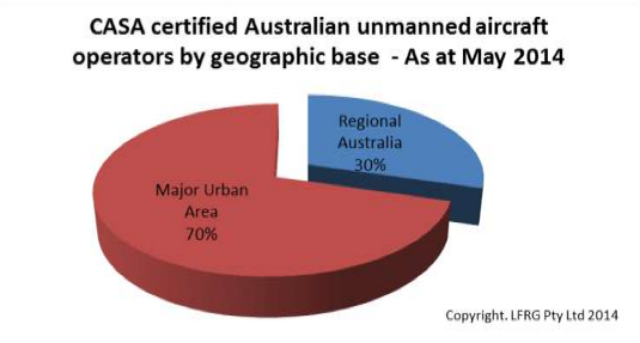

A further important trend identified by the analysis is the impact the unmanned aircraft sector is having in regional Australia. One in three unmanned aircraft start-ups which have secured CASA operating certificates come from regional areas.

“We believe this trend reflects the early adoption of small commercial unmanned aircraft by the mine surveying and agricultural sectors” says Urli. “The mine surveying segment is particularly well developed in Australia with multiple firms engaged in this commercial activity in most states.

“Adoption by the agricultural sector is still in its very early stages and is closely aligned with the slow evolution of the precision agriculture industry in Australia.

“While many system developers envisage the agricultural unmanned aircraft evolving in market terms in the same way as the tractor, the continual market lesson being learnt by certificated operators is that unmanned aircraft have a closer parallel to the laptop computer. Data is the core of all forms of precision agriculture techniques and data is what agricultural unmanned aircraft produce.

“We assess the agricultural market as having significant growth potential for the unmanned aircraft operators community and this, in turn, is likely to see continued and potentially accelerated expansion of our industry into regional areas. It is not out of the question that the number of certified operators based in regional areas could rise to above 40% of the overall total in the medium to long term, with important regional employment effects.”

Analysis of the certificate holders reveals that no Australian university or public funded research agency yet holds an operators certificate, despite widespread usage of unmanned aircraft by these entities in their education and research activities.

“ACUO is deeply concerned by this trend and urges the Australian academic and tertiary sector to back safe aviation practices and progress the pursuit of active certification for their operations as a matter of priority,” says Urli.

“There is no exemption for Australian universities and research agencies from compliance with CASA regulations where their research activities involve manned aircraft, nor is there any such exemption provided by CASA regulations for unmanned aircraft.”

The dominance of micro and small enterprises in the overall makeup of the certificate holders base reiterates the overwhelming strength of the services side of the unmanned aircraft systems sector in Australia, as opposed to a manufacturing focus says Urli

“The bulk of the actual unmanned aircraft types operated in the Australian market are sourced commercially from Europe, the United States and increasingly, China.

“Small multi-rotor, vertical take-off and landing systems form the bulk of the domestic fleet, which now numbers in the thousands of individual aircraft.

“That offshore sourcing comes despite the technology being in clear reach of Australian manufacturers, and means those few local firms engaged in full systems development are required to compete at a global level from the earliest stages of start-up.

“That pressure is both a burden and a blessing” says Urli.

“It acts as a brake on technological innovation in hardware terms at the domestic level. It acts as an additional hurdle for prospective uptake of those new capabilities emerging from the Australian research and development sector.

“But it strongly suggests that the primary thrust of domestic innovation, what competitive edge Australia can take out onto the global stage, will necessarily have to be in the form of business models which cross traditional sectorial boundaries. That applies not just to new system developers, but to all operating certificate holders and this is precisely what is happening in Australia.”

The full list of CASA certificate holders can be viewed here.

About ACUO:

Established as a legal entity in March 2010, ACUO is the peak industry body chartered to promote the safe & orderly growth and expansion of the commercial unmanned aircraft industry in Australia. ACUO represents Australia globally as part of the International Remotely Piloted Aircraft Systems Coordination Council, the pre-eminent global policy coordination body for this important sunrise industry.

Notes on data:

The analysis of Australian unmanned aircraft systems certificate holders used as the basis for this release has been conducted for ACUO by LFRG Pty Ltd, which is internationally recognised for its expertise and knowledge of the underpinning business models and practices of the global unmanned aircraft systems sector.

Classification of companies in this analysis has followed standard Australian Bureau of Statistics definitions, with the exception of grouping non-employing businesses (i.e. sole proprietorships and partnerships without employees) with the micro business category – that is businesses employing less than 5 people, including non-employing businesses. Small business is defined as businesses employing 5 or more people, but less than 20 people. Medium is defined as a business employing 20 or more people but less than 200 people, while large business is defined as entities employing more than 200 people.

Insitu Pacific and AAI Aerosonde are stand-alone Australian subsidiaries of, respectively, Boeing Company and Textron. For the purposes of this study these subsidiaries have been assessed in isolation to their parent company.

Source: Press Release