We received this interesting piece of research from reader Miles Grimshaw that we thought was well worth publishing. Miles is an investor at Thrive Capital (backing OpenGov, Warby Parker, Spotify and more). He has a professional and personal interest in the UAV and related markets e.g., mapping, computer vision.The 3 main companies building non-military consumer drones that Miles covered are:

We received this interesting piece of research from reader Miles Grimshaw that we thought was well worth publishing. Miles is an investor at Thrive Capital (backing OpenGov, Warby Parker, Spotify and more). He has a professional and personal interest in the UAV and related markets e.g., mapping, computer vision.The 3 main companies building non-military consumer drones that Miles covered are:

- DJI, the ‘Apple’ of drones that generated revenues of ~$131M in 2013

- 3D Robotics, raised $35M in venture capital and by mid-2013 had sold over 30k units

- Parrot, a public European company

Parrot is the only public company, and therefore the only company for which we can get data to use as an indicator for current consumer and enterprise demand. Parrot manufactuers the popular consumer Parrot AR Drone, and the enterprise eBee drone.

Parrot KPIs

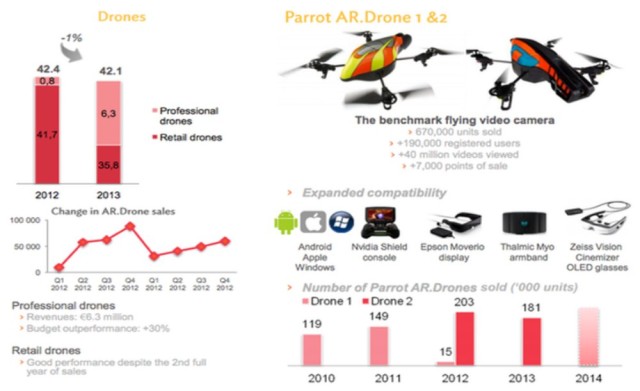

- Earned a total of 42.1M Euros in revenue from drone sales in 2013

- Total Q4 2013 revenue from drones was 13.8M Euros, down 18% in vs. Q4 2012 (16.8M Euros)

- Sold 283,000 of the AR 1 between 2010 and 2012

- Sold 324,000 of the AR 2 between 2012 and Q3 2013

- Sold 400+ eBees in 2013

- senseFly (makers of eBee) recorded $3.25MM in sales in the first half of 2013

- ~$2M in 2012 revenues from senseFly professional drones

- Pix4D, software for post-flight imagery processing, already has ~1k users

- Total registered AR flight time of 7Y 316D

Consumer vs. Professional Drone Sales

- Consumer drone sales (the AR Drone) peaked in Q4 2012 when the company sold almost 100k units

- Professional drone sales has grown almost 800% year-on-year to 6.3M Euros in 2013, up from 0.8M Euros in 2012

- Professional drone revenue was 2M Euros in Q4 2013, up from 0.8M Euros in Q4 2012

- Retail drone revenue was 11.8M Euros in Q4 2013, down from 16.0M Euros in Q4 2012

Drones vs. GoPros

- Parrot sold 218,000 AR Drones in 2012, and GoPro sold 2,316,000

- Parrot sold 181,000 AR Drones in 2013, and GoPro sold 3,849,000

- Parrot sold ~283,000 over 2010 and 2011. GoPro shipped 1,145,000 units in 2011 alone

Source: Mile Grimshaw

Your piece on the commercial drone market may be misleading in the sense that GoPro makes cameras, only a fraction of which are attached to drones.

Roy, great point. I don’t think the data is trying to lead in any particular direction, rather just provide some grounding truths about what is happening. GoPro is an interesting data point to compare to as it is a very successful consumer hardware company. You could make the argument that only a fraction of GoPros are attached to drones, but you could also argue that every GoPro owner is a potential customer for something like the DJI Phantom 1.

Miles, the hobby toy companies you noted above got early traction from enthusiasts but those platforms don’t translate into commercial applications. They’re trying to pitch it that way but commercial applications demand rugged, commercial equipment and those will never qualify.

On the opposite end of the spectrum, (some) military contractors are building larger and more rugged systems but they’re designed for military use and don’t translate into domestic, civilian applications. They’re also too manpower intensive and expensive.

Olaeris is pioneering the center between this divide. As we gain ground and others follow us, a wider separation between military UAS and toy UAS will occur. None of the toy companies above can carry multi-redundant sensors, auto-sense and avoid like lidar and radar and the many other mandatory components that will be required of commercial, domestic UAS. So in this interim stage, they’re enjoying success with an uneducated market. But after you buy your first junker car and grow tired of repairing it, you learn what you really want and need so you become more critical as a buyer. That’s the period we are in now.

Also, expect sweeping changes in the insurance coverage for toy UAS platforms that are being fobbed off as commercial equipment. We have been educating the aviation underwriters who are tired of paying out 100% write-off claims every time one crashes.