Allianz Global Corporate & Specialty SE (AGCS

Allianz Global Corporate & Specialty SE (AGCS

), the corporate insurance carrier of Allianz SE, is working with InsurTech startup Flock to develop digital insurance solutions for the growing drones or ‘Unmanned Aircraft Systems’ (UAS) market. The partnership’s first product, to be launched later this year in the UK market, is a mobile app (for Android and iOS devices) enabling operators to purchase ‘pay-as-you-fly’ drone insurance at the touch of a button.

Use of drones in public airspace increasing dramatically

According to the AGCS report Rise of the Drones – Managing the Unique Risks Associated with Unmanned Aircraft Systems , drones are fast becoming a multi-billion dollar industry, as the number of recreational users grows and the benefits businesses can gain from utilizing such innovative technology becomes apparent. The number of UAS is set to triple by 2020.[1] Globally, UAS market volume is forecast to reach 4.7 million[2] units by 2020 (other estimates are even higher), with the market for commercial application of UAS technology estimated to soar from $2bn to $127bn[3]. Such projections are driven by drones becoming cheaper, smaller and easier to use, as well as regulatory progress around the globe.

The potential value of the global commercial drone insurance market is set to reach $1bn by 2020[4]. However, the increasing number of drones in the skies also brings new risks, such as collision with aircraft, buildings and people. The number of near-misses with aircraft is a growing concern, resulting in the UK government’s announcement that drones of a certain size will need to be registered and users take a safety test in future. Drone insurance has a vital role to play in protecting operators and the public from such risks.

Allianz and Flock to launch UK’s first pay-as-you-fly drone insurance

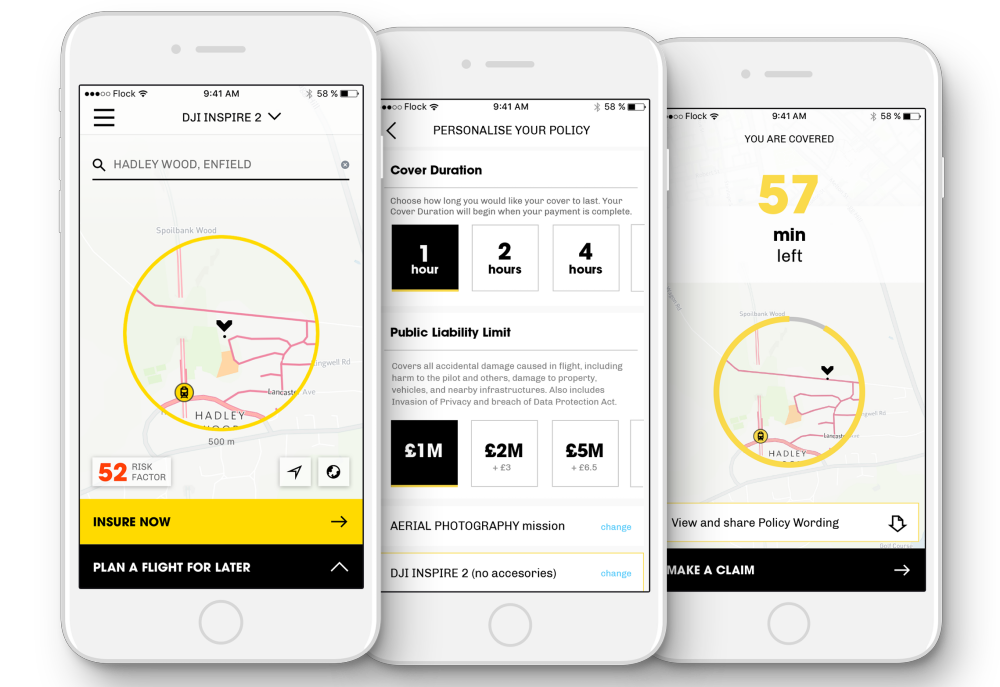

Flock, working with Allianz, will deliver on-demand drone insurance through a simple, easy-to-use app for commercial and recreational drone users. Flock has partnered with world-leading data providers to aggregate real-time data relevant to drone flight risk such as drone data, operator profiles, environmental data, and hyperlocal weather conditions (accurate to within a few minutes and a few hundred meters). Flock’s algorithms convert this real-time geospatial data into a risk metric, and then an insurance premium for commercial or recreational drone flights.

Pilots will be fully insured for their flight time, within a specified geographical region – all of which is customisable at the point of sale, or can be scheduled in advance. The ‘Flock Cover’ app will also provide drone pilots with a comprehensive safety tool, alerting them to ground hazards, real-time weather updates, Notice to Airmen (NOTAMS), and restricted airspace.

Brian Kirwan, UK CEO, AGCS said:

“Twenty-two incidents involving commercial airliners and possible drones were investigated by the Civil Aviation Authority’s Airprox Board in the first four months of this year alone. As drone usage increases, new risk exposures will emerge including the risk of cyber-attacks and terrorism. Further incidents are also likely to occur once regulations are finalized that strike a balance between reaping the benefits of drones and minimizing misuse. Future incidents could result in multi-million pound claims against businesses, operators and manufacturers,” Kirwan continued.

Tom Chamberlain, Underwriting Manager for Aerospace and General Aviation, AGCS added:

“Allianz is at the forefront of insuring the rapidly expanding UAS industry and we’re excited to partner with Flock to explore Big data driven risk intelligence solutions directly addressing the safety and insurance needs of both commercial and recreational users. This partnership further aligns with Allianz’s digital strategy to focus on new distribution channels for our products and provide enhanced customer journeys in a technologically and digitally changing landscape.”

Ed Leon Klinger, Flock’s CEO, said

“Flock is reinventing drone insurance from the ground up. Increasing drone use will bring complex risks. Flock uses cutting edge data analytics to identify and quantify these risks and together with Allianz, you’re now able to insure against them. Our app puts control back into the hands of the pilot, allowing them to purchase insurance exactly when they need it and fully customized to the needs of their job”. Klinger continued “Allianz are a world leading authority in aviation. With their expertise, and Flock’s cutting edge technology, this partnership has the potential to redefine drone safety and insurance.”

The Flock Cover app will be launching later this year and Flock have now opened up early access to beta-testers, with signup available through their website.

Flock and Allianz will be announcing more products in the coming months.

[1] FAA Aerospace Forecast FY2016-2036

[2] Unmanned Aerial Vehicles Market, By Value and Volume Analysis and Forecast 2015-2020 – Research and Markets

[3] Drones will take $127bn worth of human work by 2020, PwC says. Clarity from above – PricewaterhouseCoopers

[4] Allianz Global Corporate & Specialty

Source: Press Release