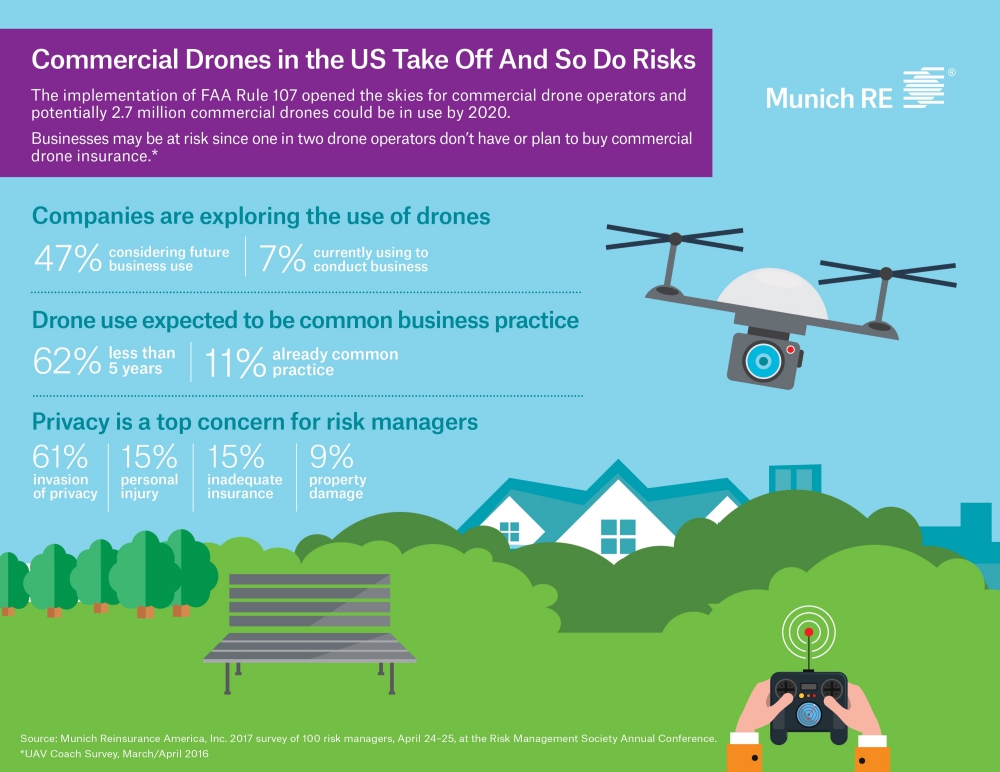

When it comes to commercial drones usage, 61% of risk managers are concerned about the potential for invasion of privacy, according to a 2017 survey conducted by Munich Reinsurance America, Inc. (Munich Re, US).

Other concerns include inadequate insurance (15%), personal injury (15%) and property damage (9%).

“With the use of commercial drones soaring, it is revolutionizing how many companies conduct and grow their businesses”

In August 2016, the Federal Aviation Administration (FAA) issued operational rules that would allow for commercial use of unmanned aircraft systems (UAS) or drones in U.S. airspace for operators who complete a certification process. The FAA anticipates commercial drones’ sales to reach 2.7 million by 2020.

“With the use of commercial drones soaring, it is revolutionizing how many companies conduct and grow their businesses,” said Gerry Finley, Senior Vice President, Casualty Underwriting, Munich Re, US. “Drones can be used by farmers to monitor fields for pest management, or by an energy company to monitor a solar panel ‘farm.’ We may even see drones deliver packages for an online retailer on a daily basis. As the use of drone technology continues to evolve, the insurance industry will need to be prepared with innovative products and services to help its customers understand and manage the emerging property and liability risks involved.”

The majority of risk managers surveyed (62%) expect commercial drone usage to become common practice for businesses in less than five years – a significant increase from the 37% who believed this in 2015. Eleven percent of respondents consider drone usage already a common practice. Since approval of the FAA’s new operational rules last year, one in two (46%) risk managers would consider or explore the use of drones within their own businesses, and 7% are already using drones to conduct business.

“New FAA regulations have encouraged the commercial use of drones across a broad spectrum of industries,” said Tim Brockett, Senior Vice President, Reinsurance Division, Munich Re, US, “and more companies and public entities are exploring new, safe and cost effective ways to use drone technology. However, they may be at risk since most commercial insurance policies don’t cover or offer very limited liability protection for drones. We recently launched a Drone Liability Endorsement to help address this emerging market need.”

Methodology:

The survey was conducted on-site at the Risk Management Society (RIMS) Annual Conference in Philadelphia, PA from April 24-25, 2017, and is intended to represent the views of 100 risk manager attendees who participated in the in-person interviews.

Munich Re stands for exceptional solution-based expertise, consistent risk management, financial stability and client proximity. This is how Munich Re creates value for clients, shareholders and staff. In the financial year 2016, the Group – which combines primary insurance and reinsurance under one roof – achieved a profit of €2.6bn. It operates in all lines of insurance, with over 43,000 employees throughout the world. With premium income of around €28bn from reinsurance alone, it is one of the world’s leading reinsurers. Especially when clients require solutions for complex risks, Munich Re is a much sought-after risk carrier. Its primary insurance operations are concentrated mainly in ERGO, one of the leading insurance groups in Germany and Europe. ERGO is represented in over 30 countries worldwide and offers a comprehensive range of insurances, provision products and services. In 2016, ERGO posted premium income of €16.0bn. Munich Re’s global investments (excluding insurance-related investments) amounting to €219bn are managed by MEAG, which also makes its competence available to private and institutional investors outside the Group.

Source: Press Release