The world of aerospace technology is constantly evolving and companies like AeroVironment (NASDAQ:AVAV) are at the forefront of unmanned aircraft systems and electric transportation solutions. However, recent news suggests that Pinnacle Associates Ltd. has reduced its position in AeroVironment by 2.2% during the fourth quarter. This drop in shares may be intriguing for those who want to know more about the company’s financial performance.

According to its most recent Form 13F filing with the Securities & Exchange Commission, Pinnacle Associates Ltd. owned approximately 0.99% of AeroVironment worth $21,335,000 at the end of the most recent quarter after selling 5,540 shares during that period. While this may not seem like a significant amount, it can be indicative of investor confidence in an organization.

AeroVironment’s last quarterly earnings report showed some mixed results as well. While the aerospace company reported $0.33 earnings per share for the quarter, it missed analysts’ consensus estimates of $0.34 by ($0.01). The company had revenue of $134.40 million during the quarter, however, which was up 49.2% on a year-over-year basis.

Despite these mixed financial results, AeroVironment remains a leader in its field as evidenced by its engaging design and development of unmanned aircraft systems and electric transportation solutions since its founding by Paul B. MacCready Jr., in July 1971.

As we watch how other investors may react to Pinnacle Associate Ltd.’s decision to reduce their ownership stake in AVAV along with other market indicators, it will be interesting to see where AeroVironment goes next within this ever-evolving industry as they look forward towards continued innovations in aerial technologies and beyond.

AeroVironment’s Shares Gain Investor Interest as Hedge Funds Make Significant Transactions

AeroVironment, Inc. is a veteran in the unmanned aircraft systems and electric transportation business, which has recently gained investors’ interest. Notably, several hedge funds have made significant transactions involving AeroVironment’s shares. During the first quarter, Cambridge Investment Research Advisors added an extra 60.5% holding of AeroVironment’s shares to its portfolio by acquiring 3,066 more assets worth $766,000. PNC Financial Services Group also purchased 1,291 additional shares boosting its total ownership of AVAV by 54.1%, valued at $348,000 in April 2021. Furthermore, Natixis Advisors L.P increased their position in AVAV by over 20% for approximately $1.736 million while Bank of Montreal Can hiked possession of their shares through the acquisition of another 894 holdings for $656,000.

Reaffirming shareholders’ confidence in the firm was MetLife Investment Management LLC that augmented ownership by buying extra AeroVironment stocks worth $1.114 million during the same period – an increase of about 41.4%. Of note is that hedge funds and institutional investors hold about 88.82% of the company’s equity.

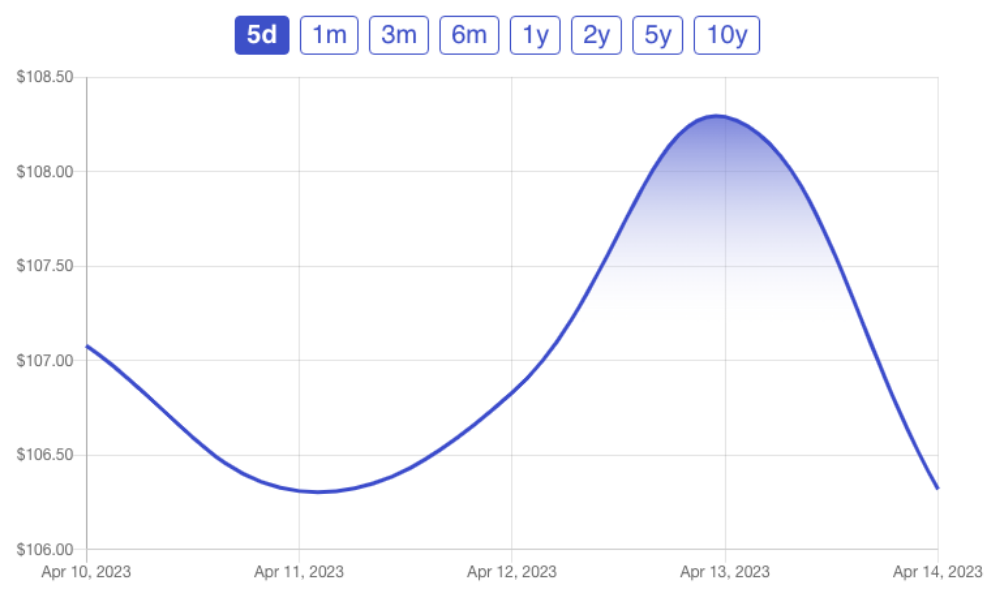

As markets closed temporarily on Friday following holidays commemorating Eid al-Fitr around the world where majority-Muslim countries aim to spread positivity and unity post-fast during Ramadan; investors pushed back from bidding higher prices as only a modest sum ($32K) influenced trades against an average volume turnover per session (206+K). With a closing price of down $1069 per share (-$1.34 or -1)% on Friday comfortably close to its one year high at $1090 apiece with a floating share count up to almost 29 million internationally trading assets; there is still room for more magnificent waves for any interested alpha or retail quantitative traders worldwide on this billion-dollar patent innovator cap hovering around $3.15 billion.

Consequently, Raymond James analysts upgraded the firm from an outperform rating to a strong-buy rating while Canaccord Genuity Group also upgraded AeroVironment’s price target from $106 to $115 for AVAV shares in March 2021. The Royal Bank of Canada released their research report on AeroVironment affirming an ‘outperform’ rating with a price objective of $115 per share. Furthermore, based on data gathered by Bloomberg.com, the market has given AeroVironment’s shares a consensus moderate buy rating and set a target price of about 110.67.

Only recently, Stephen F. Page – one of the directors at AeroVironment – disposed of some stocks in hand and sold off more than 2K worth of AVAV assets valued at around $90 apiece but still kept close to his company’s stock as he maintains ownership over more than 45K units grappling above 4 million dollars toppling any fears investors could have potentially harboured. In conclusion, as AeroVironment further solidifies its position as an innovator par excellence that focuses on delivering quality products and technology platforms for global development projects domestically and globally; its growth trajectory is expected only to cement its position as one of America’s leading manufacturers and pioneers in the aerospace industry regardless of upcoming earnings results announcements unless any geopolitical effects interfere with trading indices during this financial year.

Source: Best Stocks