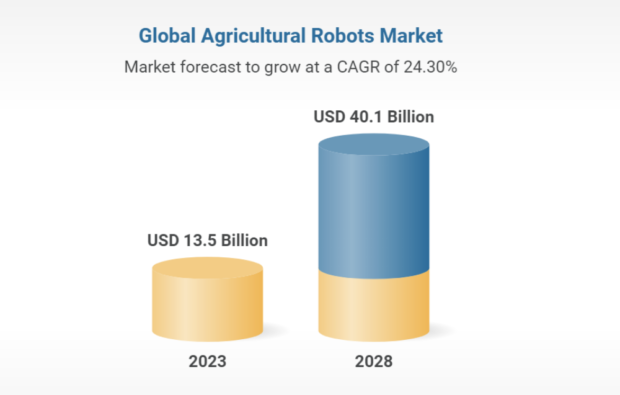

The agricultural robots market is projected to grow from USD 13.5 Billion in 2023 to USD 40.1 Billion by 2028, at a CAGR of 24.3% during the forecast period. Increased awareness about digital agriculture is driving the widespread usage of agriculture robots as farmers recognize the transformative potential of advanced technologies in modernizing and optimizing farming practices.

Digital agriculture encompasses the integration of cutting-edge technologies such as robotics, artificial intelligence, data analytics, and the Internet of Things (IoT) into traditional farming methods, unlocking new possibilities for increased efficiency, sustainability, and productivity. One of the key drivers of agriculture robot adoption is the growing understanding of the benefits they offer. With increased awareness, farmers are recognizing that these robots can automate labor-intensive tasks, reduce operational costs, and enhance overall farm management. By leveraging advanced sensors and AI algorithms, agriculture robots can collect real-time data on soil health, crop conditions, and weather patterns, enabling data-driven decision-making and precision farming practices.

The “Agriculture Robots Market by Type (Unmanned Aerial Vehicles/Drones, Milking Robots, Driverless Tractors, Automated Harvesting Systems), Farming Environment (Indoor and Outdoor), End-use Application and Region – Global Forecast to 2028” report analyses this development and has just been published by ResearchAndMarkets.com.

This remarkable growth is underpinned by an increasing cognizance of digital agriculture’s transformative potential. Farmers are embracing the integration of cutting-edge technologies such as robotics, artificial intelligence, data analytics, and the Internet of Things (IoT) into traditional farming practices.

This convergence births a new era of efficiency, sustainability, and productivity, enabling laborious tasks to be automated, costs to be curtailed, and farm management to be elevated. Central to this evolution are various agricultural robots, from unmanned aerial vehicles (UAVs) to milking robots, automated harvesting systems, driverless tractors, and more.

As the market matures, drones initially lead the pack, yet driverless tractors, propelled by rapid commercialization, are poised to take the lead in the near future. This paradigm shift finds its fulcrum in Europe, where a professional and technologically driven landscape promises substantial growth.

As the industry’s horizon expands, notable entities like DJI, PrecisionHawk, Trimble Inc., and Yamaha Motor Co., among others, are at the forefront of this dynamic metamorphosis.

The Outdoor Segment is Expected to Account for the Largest Share in 2023

Agriculture robots are set to revolutionize outdoor farming applications, offering numerous benefits that will transform the way farming is conducted. These advanced machines, equipped with cutting-edge technologies, are poised to address critical challenges faced by farmers and enhance productivity, sustainability, and efficiency in outdoor farming.

Agriculture robots can perform tasks with unmatched precision, thanks to their advanced sensors, GPS technology, and artificial intelligence capabilities. They can accurately plant seeds, apply fertilizers, and dispense pesticides, reducing waste and optimizing resource usage. Precision farming ensures that crops receive the right amount of inputs precisely where they are needed, leading to increased yields and cost savings.

The Farm Produce Sub-Segment is Projected to Dominate the Market Share in the End-User Segment During the Forecast Period

Agricultural robots will revolutionize farm produce by enhancing efficiency and productivity. These robots can autonomously perform various tasks, such as planting, weeding, harvesting, and monitoring crops. With precise data collection and analysis, they optimize resource usage and reduce waste.

Additionally, robots can operate 24/7, ensuring timely actions, even in adverse conditions. Their consistent performance improves crop quality and yield. By minimizing manual labor, farmers save time and costs, enhancing their profitability. Moreover, agricultural robots promote sustainable practices by using fewer chemicals and reducing environmental impact. Overall, these technological advancements empower farmers to meet rising demands and secure a more food-secure and sustainable future.

Driverless tractors are expected to be utilized on a large scale – despite their high price – as labor costs keep rising. Various AGVs are expected to be utilized for farming field crops for planting, spraying, and weeding. Since field crops require extensive farmlands, UAVs are also expected to be utilized on a large scale in field crops compared with other types of agricultural produce.

Hence, field crops are expected to have the highest share of the market and the highest growth rate during the forecast period.

Europe is to Grow Significantly During the Forecast Period

According to the European Committee of Farm Machinery Manufacturer’s Associations (CEMA), the European agricultural machinery market is currently growing, which is expected to fuel the growth of the agricultural robots market as well. The major factors contributing to the agricultural robots market’s growth in Europe include improved productivity through mechanization, an optimized supply chain, and increasing labor cost owing to the shortage of skilled labor. Uncertainty regarding government support, low farm income, and import restrictions from Russia are the major restraints.

The European agricultural machinery industry is one of the most developed in the world and is supported by the presence of global players, such as John Deere (US), Small Robot Company (UK), Earth Rover (UK), Saga Robotics (Norway), CNH Industrial (The Netherlands), and AGCO Corporation (US).

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 315 |

| Forecast Period | 2023 – 2028 |

| Estimated Market Value (USD) in 2023 | $13.5 Billion |

| Forecasted Market Value (USD) by 2028 | $40.1 Billion |

| Compound Annual Growth Rate | 24.3% |

| Regions Covered | Global |

Premium Insights

- Increasing Demand for Precision Farming Solutions, Potential for Labor Optimization, and Growing Focus on Sustainable Agriculture Practices to Drive Market Growth

- US to Account for Largest Market Share During Forecast Period

- Farm Produce Segment and US to Account for Largest Shares in North America in 2023

- Unmanned Aerial Vehicles to Dominate Agriculture Robots Market in 2023

- Outdoor Segment to Dominate Agriculture Robots Market During Forecast Period

- Farm Produce to Dominate Agriculture Robots Market During Forecast Period

- Field Farming to Dominate Agriculture Robots Market During Forecast Period

Market Overview

Drivers

- Increase in IoT Devices Connected with Farm Management to Analyze Data on Various Factors

- Demand for Optimization of Farm Management Using Agricultural Drones and Robots

- Rapid Adoption of Advanced Technologies

- Growth in Concerns Regarding Ecosystem Change

- Benefits Offered by Livestock Monitoring

Restraints

- High Cost of Automation for Small Farms

- Technological Barriers Pertaining to Fully Autonomous Robots

- Compared to Drones and Milking Robots, Most Harvesting and Weeding Robots Still in Prototype Stage

- Fragmented Nature of Farmland in Developing Countries to Make It Difficult to Adopt Agricultural Robots

- Lack of Training Activities in Operating Drones

Opportunities

- Untapped Market Potential and Scope for Automation in Agriculture

- Use of Real-Time Multimodal Robot Systems in Fields

- Increased Use of Electrification in Agricultural Robots

- High Adoption of Aerial Data Collection Tools in Agriculture

- Increase in Use of Agricultural-Based Software Via Smartphones

- Early Detection of Crop Diseases and Ease of Farm Management

- Convergence of Digital Technologies with Farming Practices

Challenges

- Lack of Standardization of Agricultural Robot Technologies Globally to Post as Challenge

- High Cost and Complexity of Fully Autonomous Robots

- Standardization of Communication Interfaces and Protocols for Precision Agriculture

- Lack of Technical Knowledge Among Farmers

Macroeconomic Indicators

- Reduction in Arable Land

- Rapid Digitalization

Industry Trends

Value Chain Analysis

- Research & Development (R&D)

- Hardware Component Manufacturers and Software Providers

- Robot Manufacturers

- End-users

- After-Sales Services

Market Ecosystem

- Upstream

- Downstream

- Research & Development Centers

- Hardware Component Providers and Software Providers

- Hardware Component Providers

- Software Providers

- Software Solution Providers

- It/Big Data Companies

- Agriculture Robots Oems

Case Study Analysis

- Use Case 1: Eavision Launches Intelligent Agricultural Spraying Drone in China

- Use Case 2: Parrot Launches Anafi Thermal

- Use Case 3: Anna Binna Farms Used Agworld Software Platform for Farm Record-Keeping

Technology Analysis

- Ai in Agriculture

- Crop Yield & Price Forecast

- IoT

- Advanced Unmanned Aerial Vehicles

Company Profiles

Key Players

- Deere & Company

- Dji

- Cnh Industrial Nv

- Agco Corporation

- Delaval

- Trimble Inc.

- Boumatic Robotics

- Lely

- Agjunction

- Ageagle Aerial Systems Inc.

- Yanmar Co.

- Deepfield Robotics

- Ecorobotix

- Harvest Automation

- Naio Technologies

Other Players

- Robotics PlUS

- Kubota Corporation

- Harvest Croo Robotics

- Autonomous Tractor Corporation

- Clearpath Robotics, Inc.

- Dronedeploy

- Agrobots

- Ffrobotics

- Fullwood Joz

- Monarch Tractor

More information about this 315-page report visit can be found here.

Source: Press Release