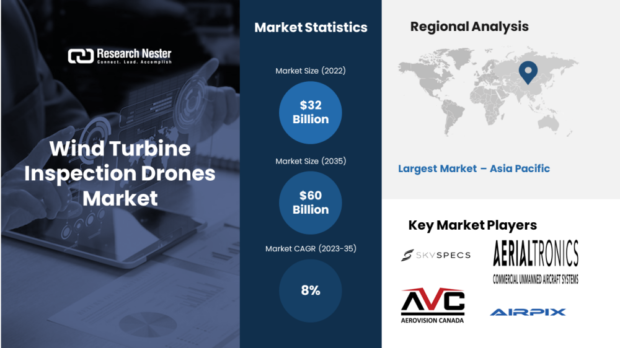

The global wind turbine inspection drones market size is slated to expand at 8% CAGR between 2023 and 2035. The market is poised to garner a revenue of USD 60 billion by the end of 2035, up from a revenue of USD 32 billion in the year 2022. The rising investment in wind energy technologies is the major factor that is driving the market growth.

In 2022, global investments in wind energy technologies will total approximately 175 billion US dollars. Over the last decade, investment has expanded significantly. Wind energy investments totaled around 75 billion US dollars in 2011.

Wind Turbine Inspection Drones Market: Key Takeaways

- Market in the Asia Pacific region to propel the highest growth

- The Offshore Wind Energy segment to garner the highest growth

- Market in North America to grow at a highest rate

Rising Loss of Energy is to Boost the Growth of Market

Owing to the disturbance in maintenance and operation, around 25% of the total cost of wind energy is lost. there is a great need to improve wind energy competitiveness by improving wind energy system reliability and lowering O&M costs. About fifteen percent is due to maintenance actions and downtime revenue loss due to wind turbine (WT) failures. Proper maintenance, safeguarding inspections, and time-based preventive maintenance depending on consistent intervals or component age are all typical maintenance practices in the wind energy business. A Wind turbine was primarily seen as a series system, with components connected in series. However, failures of certain WT components, such as sensors, might result in partial failures of wind turbines with diminished power generation aptitude therefore the need for frequent inspection becomes really important.

Wind Turbine Inspection Drones Industry: Regional Overview

The global wind turbine inspection drones market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Rising Export of Drones from the Region is to Elevate the Market Growth in Asia Pacific

The demand for inspection drones is continuously rising owing to the usage of these drones can aid in the detection of possible problems such as water leaks, damage to the structure, deterioration, and so on. The expanding global demand for energy will enhance the discovery of these plants, increasing the demand for inspection drones from all across the world and thus boosting the export of wind turbine inspection drones from the manufacturing hub to other nations. Garuda Aerospace, an Indian drone company, is striving to meet contracts from overseas customers for 8,000 drones that will be used for agriculture (pesticide spraying), commercial inspection, and cartography. Moreover, aside from these drones, which must be shipped to clients in the UAE, Malaysia, and Panama, the company is also working on completing transactions with Indian government-run and private entities.

Rising Manufacturing of Drones is to Elevate Wind Turbine Inspection Drones Market Growth in North America

Commercial drone manufacturing and related services are predicted to grow from roughly USD 8 billion to USD 20 billion by 2026 in the United States. This will expand the production of drones for wind turbine inspection purposes while also increasing public accessibility. The growing production of drones will increase the sales of wind turbine inspection drones in the region. Furthermore, the government in the region is taking special initiatives to boost the share of wind energy in total power production. This motive is served by the establishment of money plants for wind energy and also putting heavy investment in the same.

Wind Turbine Inspection Drones Segmentation by Drone Type

- Fixed-Wing Drones

- Rotary-Wing Drones

- Multirotor Drones

Wind Turbine Inspection Drones Segmentation by Application

- Blade Inspection

- Tower Inspection

- Nacelle Inspection

The blade inspection segment in the wind turbine inspection drones market is expected to garner the largest market share by the end of 2035. The growth of the segment is attributed to the installment of gigantic wind blades in the complete setup of wind energy. For instance, LM Wind Power has designed the world’s largest wind turbine blade, the LM 88.4 P, besides being the largest it is one of the most advanced blades in the world. It is around a 107-meter-long blade and is longer than a football pitch and 1.4 times the length of a Boeing 747. The three of these blades are going to make up the rotor of GE’s Haliade-X 12 MW offshore electricity turbine, which is geared towards powering 16,000 European homes.

Wind Turbine Inspection Drones, Segmentation by Energy Type

- Offshore Wind Energy

- Onshore Wind Energy

Wind turbine inspection drones market from the offshore wind energy segment is expected to be responsible for the dominant revenue share during the forecast period. The growth of the segment is majorly due to the rising installment of offshore wind projects. Besides this, the onshore wind energy segment is also gaining huge traction owing to higher investment in the onshore projects. In comparison to the installed capacity in 2018 (542 GW), the global average installed capacity of onshore wind power will more than triple by 2030 to 787 GW and by nine times by 2050 to 5 044 GW. Furthermore, China will continue to dominate the onshore wind power market in Asia, accounting for more than half of global installations by 2050, followed by North America (23%) and Europe (10%).

Wind Turbine Inspection Drones Segmentation by End Uses

- Wind Farm Operators

- Service Providers

- Original Equipment Manufacturers

A few of the well-known market leaders in the global wind turbine inspection drones market that are profiled by Research Nester are Microsoft Corporation, Adobe Inc., Cisco Systems, Inc., IBM Corporation, Radisys, Huawei Technologies, OmniSci, Inc., Dell, Inc., Techvantage, Anodot Ltd., and others.

Recent Developments in the Market

- HUVRdata has recently launched a new product, AirData UAV in their HUVR Partner Network (HPN). The addition was announced at the ASME’s Robotics for Inspection and Maintenance. Both HUVRdata and AirData features are designed specifically for autonomous measurement equipment for industrial inspections. They also allow robots to help preserve adherence to standards defined by various governing agencies, such as API, DOT, FAA, and TC. With the addition of AirData as a partner, HUVR will now be able to provide customers with the opportunity to view and manage both inspection data and pilot and drone flight details on one interface.

- Nearthlab a leading drone technology company has announced to sign a formal agreement with ONYX Insight, a provider of predictive maintenance solutions. Owing to this collaboration, the companies will provide the world with a predictive maintenance solution for wind turbines on a single platform.

Source: Press Release