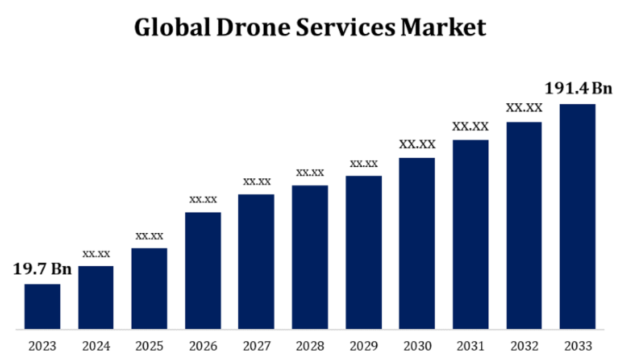

The Global Drone Services Market Size to Grow from USD 19.7 Billion in 2023 to USD 191.4 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 25.53% during the forecast period, according to a new study by Spherical Insights.

Technology improvements, such as longer flight times, more payload capacity, better sensors, and enhanced autonomous capabilities, have led to an expansion of the drone sector. Companies were investing in R&D to increase the drones’ efficiency, dependability, and affordability. The technology sector, service providers, and drone manufacturers engaged in intense competition that defined the drone business. Both established businesses and startups created novel technologies, offered specialist services, and forged strategic partnerships in an effort to increase their market share. A number of factors contributed to the growing popularity of drone services: the demand for reasonably priced aerial photography and data collection; the expansion of applications in industries like agriculture, construction, and infrastructure inspection; and the growing focus on operational efficiency and safety.

Drone Services Market Value Chain Analysis

The initial stage in the production of drones is the acquisition of raw materials, such as airframes, motors, batteries, sensors, and communication systems. Producers combine the raw materials to make finished drone items after acquiring them. This process includes drone design, prototyping, and mass manufacture. Sales teams and channels are crucial for marketing drones, educating consumers about their uses and capabilities, and closing deals. A wide range of drone services, including aerial photography and videography, mapping and surveying, monitoring and inspection, delivery services, and more, are available to customers in a number of industries. Data is collected by drones and processed and analysed by service providers to provide their clients with insights that may be put to use.

Drone Services Market Opportunity Analysis

It is anticipated that the market for drone services would expand rapidly across several industries, including public safety, energy, building, agriculture, and transportation. Drones can carry out tasks such infrastructure inspection, delivery services, surveillance, and agricultural monitoring to increase operational efficiency and reduce expenses. Drones are being utilised to collect data, which has increased demand for data analytics and insights services. Businesses have the opportunity to develop specialist software that receives, processes, analyses, and visualises data from drones, providing clients with actionable insights for better decision-making. Drone services are in high demand worldwide, which offers opportunities for companies to expand globally. Companies can take advantage of this growing demand by expanding internationally and forming strategic partnerships.

Insights by Service Type

The drone platform services segment accounted for the largest market share over the forecast period 2023 to 2033. It is essential to have drone platforms that are specifically made to fit the requirements and uses of various industries. In the construction industry, multispectral cameras are required for crop monitoring, while drones equipped with LiDAR sensors are necessary for site mapping and 3D modelling. Service providers serving the public safety, energy, construction, and agricultural sectors are experiencing an increase in demand for industry-specific drone platforms and solutions. Drone platforms, edge computing, machine learning, artificial intelligence, and the Internet of Things (IoT) are all becoming increasingly entangled. Drone platform service providers may develop middleware solutions, application programming interfaces (APIs), and software development kits (SDKs) to facilitate seamless interaction with third-party hardware, software, and Internet of Things devices.

Insights by Application

The surveillance and inspection segment accounted for the largest market share over the forecast period 2023 to 2033. Concerns regarding asset integrity, safety, and security are driving up demand for surveillance and inspection services, which is driving this market’s expansion. Businesses and groups are starting to realise how beneficial drones are for enhancing their monitoring and inspection capabilities, which is why drone services are becoming increasingly popular and well-funded. The surveillance and inspection segment serves a wide range of industries, including as public safety, agriculture, infrastructure, oil and gas, and security. Drones are utilised for inspecting a variety of structures, including farms, buildings, bridges, electrical lines, and pipelines, to detect leaks, structural defects, and other issues.

Insights by End Use

The infrastructure segment accounted for the largest market share over the forecast period 2023 to 2033. An increasing number of infrastructure types, including buildings, electrical lines, pipelines, roads, railroads, bridges, and pipelines, are being inspected and monitored by drones. Drones may spot anomalies, damages, and defects in infrastructure assets more rapidly and cheaply than using traditional inspection approaches thanks to the use of LiDAR, thermal imaging, and high-resolution cameras. Drones are increasingly being used in the design and constructing of infrastructure projects, including as highways, trains, airports, dams, and skyscrapers. Drones provide aerial surveys, topographic mapping, and 3D modelling, among other services that can assist with site planning, design optimisation, construction management, and progress monitoring.

Insights by Region

North America is anticipated to dominate the Drone Services Market from 2023 to 2033. The region’s cutting-edge technology, strong economy, and benevolent legal system all promote the usage of drone services across a range of industries. Journalism, public safety, infrastructure, energy, construction, and agriculture are just a few of the industries that have used drone services in North America. Businesses and organisations use drones for a range of tasks, such as aerial surveying, mapping, cinematography, delivery, inspection, and monitoring. North America, a key hub for technological innovation in the drone industry, is home to several companies and academic institutions that are developing drone hardware, software, sensors, and autonomous capabilities. Despite the potential benefits, the North American drone services business faces challenges from competition, safety concerns, privacy issues, and regulatory complexity.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Many sectors in Asia-Pacific are adopting drone services for a range of uses. Numerous industries, including construction, mining, energy, logistics, transportation, and surveying, mapping, and aerial photography and videography, use drones. Asia-Pacific is a hub of technological innovation in the drone industry. Businesses and research institutions in China, Japan, South Korea, and India are making advancements in drone hardware, software, sensors, and autonomous capabilities. Technological developments in areas like robotics, AI, and 5G connectivity are increasing the potential applications and capabilities of drones in the field.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Major Players in the global drone services market includes Aerial Drone Services Inc., Aerodyne Group, Arch Aerial LLC, AUAV, CYBERHAWK, Drone Services Canada Inc., Dronegenuity, FLIGHTS Inc., FlyGuys, NADAR Drone Company, Phoenix Drone Services LLC, TERRA DRONE CORPORATION, Wing Aviation LLC, and Others.

To get a sample PDF Brochure, click here.

Source: Press Release