This is the third article written on EHang. The first two were very bullish, and the second, Buy it now and buy it big, turned into a very profitable trade. I updated the comments section of that article with my technical charts and updates on the trades as they progressed. Here is a link if you would like to read it.

Having made such large gains, it is time to look at EHang again and measure the company’s progress.

It is a story stock that promises a great eVTOL product but has falling revenue, substantial costs, and a drone business that seems to have disappeared.

I will need clear evidence that a profitable and scalable business is at hand to reinvest.

The EH 216 and Certification

The 216 is EHang’s flagship product and, in most cases, the only product from EHang people have heard of. It is an autonomous but not intelligent Electrical Vertical Take-off and Landing aircraft; it travels along pre-set paths and routes and is destined to be a tourist attraction, short-haul people transport, and logistics drone.

The CAAC (Chinese regulatory body) recently approved the EHang Unmanned Aircraft Cloud System (UACS). The UACS software will hopefully control the airspace management and integration of multiple operators and aircraft operating at low altitudes. Significantly, this was not approval in the true sense of the word; the CAAC has given EHang the authority to conduct trial operations of the system, which is quite different from certifying the design.

At the time of writing, no part of the EH 216 is fully certified for operations.

EHang management has said they have completed the final test flights required by the board of certification, but several ground tests are ongoing. I am unsure if there will be a gap between completing the ground tasks and the final certification. I think the aircraft will likely be certified to fly under certain conditions and areas rather than complete certification the way most aircraft are.

The testing of the UCAS system will then start in earnest.

I suspect the initial certification will be for ground-based pilot and line-of-sight operations rather than fully autonomous flight.

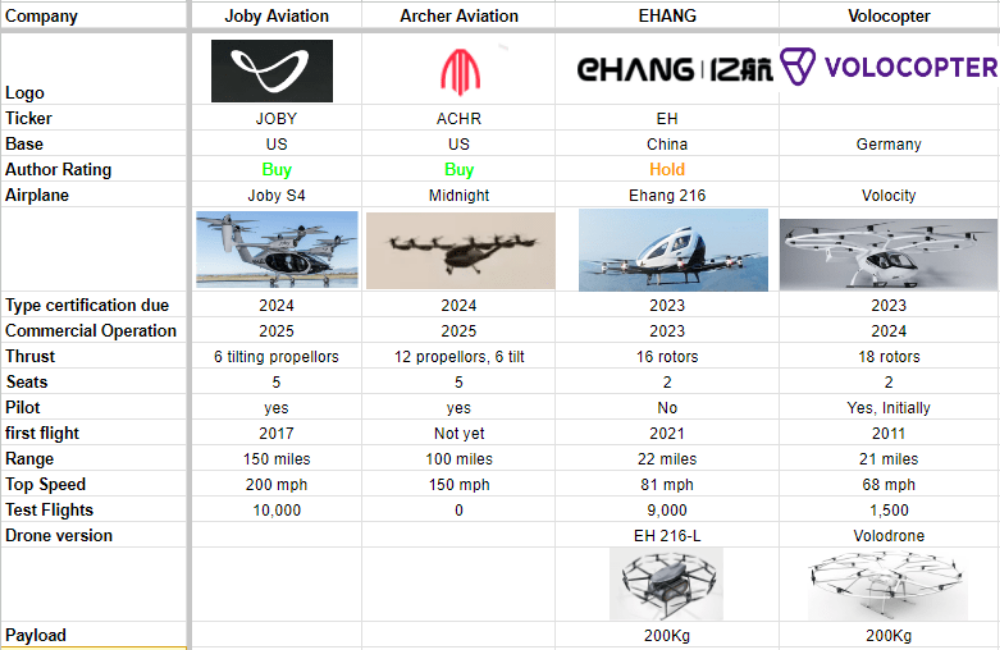

EH 216 Key Features and Competition

The closest competition to the EH 216 is the Volocopter Volocity aircraft. They have many similarities. They are both two-seater eVTOL aircraft with the cabin surrounded by a circle of small rotors. They have similar flight profiles and are likely to be the first two eVTOL aircraft to see commercial operations. Volocopter has targeted the Paris Olympics of 2024 to showcase the first commercial operations, and although we do not have such an exact date from EHang, they look like they will launch within months of each other.

The VoloCity will launch with a pilot and a single passenger and move to an autonomous operation later. The EH 216 does not have onboard flight controls and can be operated autonomously or as a drone.

The similarity of these two aircraft in terms of specifications, design, and launch date means that they will be substantial competitors to each other, and their limited specification when compared to the eVTOL planes designed to be air taxis implies that they are unlikely to be successful in that marketplace.

The EH 216 and the VoloCity have a ring of small rotors around the cockpit; the EH 216 has open rotors at knee height, which has obvious safety issues but is immaterial for flight control.

EHang is sensibly trying to develop the EH 216 as a tourist flight vehicle, delivery vehicle, and emergency response vehicle rather than targeting a taxi service. Volocopter seems to believe more in the air taxi model.

EH 216 Sales and Backorders

EHang has sold and delivered more aircraft than the rest of the eVTOL market added together.

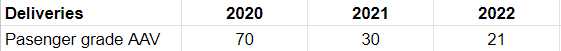

EH216 Deliveries (EH FY 2022,2021)

These sales are for the 216 and its predecessors and are predominantly delivered in China. The CEO said, “mainly operated on a limited trial basis in tourism locations in China, for testing, training and demonstration purposes” (E.H.: 2021 20-F, 2022-4-28)p68

The Order Book

It is challenging to decide on the actual value of the order book; like the other eVTOL companies, the orders depend on getting the aircraft approved. I believe the deliverable EHang order book is much lower than the 1,200 aircraft they publish. We are most likely looking at 50 or so aircraft deliveries per year for the first few years after certification.

Following obtaining the certificate of EH216-S, we will deliver the existing domestic other pipelines in a proper order, which have accumulated to more than 100 units.

(E.H.: 2023 Earnings call Q2 2023 Transcript, 2023-8-17)

The non-domestic orders, of which many (from Indonesia, Japan, Thailand, and others), will depend on certification in their home countries, which will likely take several years.

In the F.Y. 2021 annual report, EHang said they had more than 1,000 units pre-orders for their passenger grade AAV.

Probably the largest part of the EHang order book is an order from a Biotech company that I do not think is an actual order.

In April 2016, the Group entered into a development and purchase cooperative arrangement with a U.S. biotechnology company (“Biotech Customer”) to design, develop, test-run and manufacture an organ transport e-helicopter system…..

As part of the same arrangement, the group may sell 1,000 units of customized AAVs with the organ transport e-helicopter system conforming to the functional specifications by the Biotech Customer for according to a 15-year delivery schedule subject to subsequent purchase amendments……

Purchase orders are conditional on the group achieving a number of performance milestones and the Biotech Customer obtaining required approvals from the FAA and FDA for the internal testing of the AAVs…..

The customer is Lung Biotechnology, part of United Therapeutics Corporation (UTHR). The 15-year deal signed with Lung for 1,000 EH184 (now the EH 216) aircraft was to develop the Manufactured Organ Transport Helicopter (MOTH). Lung is researching the manufacture of new human organs, perhaps pig-human transplants. The MOTH deal requires FAA aircraft approval and FDA approval of Lung’s pig-human transplants.

EHang has never been mentioned in any SEC documents or any earnings calls by UTHR.

In Q2 2023 UTHR earnings call the CEO discussed the current state of Lung Bioengineering. The need for the EH 216 is not as far-fetched as I first thought. Human lungs taken from organ donors that a transplant surgeon feels are not quite ready for use in a sick patient are currently flown to one of two Lung Bioengineering sites (Maryland and Florida) where bioengineering technicians work, and about 50% of the time, they manage to improve the tissue sufficiently for a transplant to take place. The two centers provide services to 60% of US adult Lung transplant centers.

The problem for Ehang is the limited flight distance of the EH-216 and all other eVTOL planes, for that matter. An EH-216 would not be able to fly to two centers from 60% of the U.S.; it is not viable.

I believe the 1,000 machines on back order to Lung Biotechnology can be considered nonexistent.

The size of the order book was clarified by a question from Goldman Sachs (GS) in Q3 2022 earnings call and confirmed to be around 100 units.

What is the Value of the Order Book?

In Q2, the total revenues were $10 million compared with $22.2 million in Q1 primarily from the delivery of five units of EH216-S to the joint venture with a Shenzhen listed leading tourism operator in China, Xiyu tourism

(E.H.: 2023 Earnings call Q2 2023 Transcript, 2023-8-17)

This implies that the aircraft will sell for around $2 million each, which directly contradicts the statement from Nick Yang, a director of Ehang, who said the actual price will be $302,000 in March this year. In previous articles, I had calculated the price of an Ehang 216 to be $250K.

As a result of these statements, the order book has a value between $30 million and $200 million. Of course, it is nearly zero if the aircraft is not certified.

The Future of the EH-21

In respect to your second question, as you know, after our EH216-S gets its T.C. our first priority will be focusing on the so-called low-altitude tourism market.

(E.H.: 2023 Earnings call Q2 2023 Transcript, 2023-8-17)

The Ehang manufacturing site will have a capacity of 600 units per year. In the Q2 earnings call, we received an update about expected future orders in response to analyst questions.

Xiyu tourism and this cooperation will further lead to a potential order demand for about 120 units in the future five years.

Additionally, our strategic partnership with the Bao’an district of Shenzhen City is not only a very important step for our post T.C. commercial operations, but also expected to help generate potential order demands gradually.

In the coming few years, the concentration on the tourism industry, the work to complete the certification of the UCAS, and competition from the Velocity machine will likely keep the demand below 100 units per year, meaning we can expect an average revenue post-certification of around $22.5 million and gross profit of $13.5 million. (if they maintain the current 60% margin using the $302k sale price).

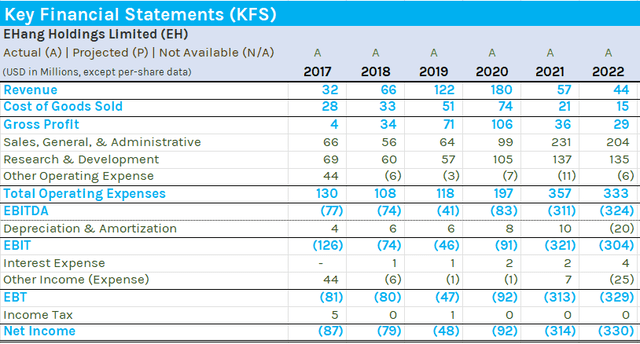

Key financial line items (Author Database)

Where has all this revenue come from? A cumulative $501 million where sales of the EH 216 should have delivered 121*$302,000 = $36 million. Even at $2 million per aircraft, we only get $222 million.

With operating costs above $300 million, the forecasts for the 216 will not get Ehang anywhere near profitability in three to five years.

EHang and the Drone Business

The Drone business has been and should be an essential part of Ehang’s revenue generation. They have a mixed relationship with drones; they pulled out of the commercial drone business, sending their U.S. and German subsidiaries into bankruptcy (E.H.: 2021 20-F, 2022-4-28) p33

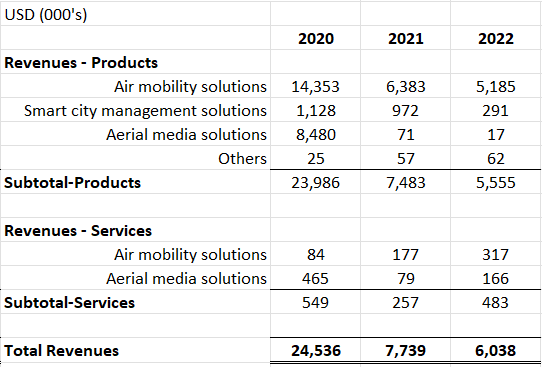

In the FY earnings calls for 2020 and 2021, management spoke at length regarding the Falcon B drone, the deal with DHL (Deutsche Post (OTCPK:DHLGY)), and the smart city concept; revenue from these products appears to be in sharp decline. The only growing line item on the accounts is Air Mobility Solutions, the ground support for the 216 aircraft sold.

revenue sectors (Author Database)

I worry that management has become so concerned with getting the flagship EH 216 aircraft certified that they have allowed the significant and profitable drone business to fall by the wayside.

DHL

When I first began researching Ehang in 2021, I thought this concept would likely be a big winner. Ehang has not mentioned it in any earnings calls or documents since 2020, and DHL has never mentioned it. I have no idea if the trial is still in operation if it was successful, or what the plans are. Ehang continues to use pictures of DHL-branded drones on its website; the video is still available on YouTube. The project is a joint venture between Ehang, DHL China, and Sinotrans (probably China’s largest delivery company)

The Falcon B Drone

We successfully introduced a practical application for both EHang 216 and Falcon B in medical emergency transportation.

(E.H.: 2020 Earnings call Q1 2020 Transcript, 2020-5-29)

Since that date, it has not been mentioned. Yet the Falcon B remains a part of the website under smart city management. On June 8 this year, a video showing the Falcon B drone in a new delivery service was released. Ehang must still be developing the drone business but is not providing any guidance, and revenue appears to be in terminal decline.

The Ehang 216 (logistics) drone is on the website, and Ehang reported five sales in the Q2 2023 earnings call in addition to the eight units delivered in 2022. Again, there is no guidance and no information about what these drones are doing or where they are operating.

The UCAS cloud software discussed at the beginning of this article may be as important for the drone business as the EH 216. It could be the backbone of the smart city concept and allow for the autonomous movement of drones in a city. If so, the Ehang drone business could come roaring back in 2024. I would like to see some guidance for this business, and without it, I struggle to see how Ehang can make a profit from the EH_216 alone.

Conclusion

The EH 216 is still in the process of certification; its cloud service that will fly the plane has been certified only to enable testing. Orders for the 216 appear to be around 100 in China, with a potential for another 100 or so in the next couple of years. Ehang has quoted a sales price of $302,000 per aircraft, but comments from the CEO imply it is nearer to $2 million. It could be infrastructure (charging control stations, etc.) that makes the difference, but it is difficult to reconcile.

Ehang historically had a significant and promising drone delivery business with what looked like important projects taking place with DHL and Sinotrans. Still, news on these has been nonexistent of late. The Falcon B drone and the smart city concept that drove revenue in 2020 remain on the website. That revenue is in severe decline, and the management has not mentioned its progress or that of its drones in recent earnings calls.

I am moving to a hold position on Ehang. I booked substantial profits last year and earlier this year, but the outlook is now clouded.

Source: Seeking Alpha